This post may contain affiliate or referral links, which means I may receive a commission if you purchase something using my link. It will be no extra cost to you. As always, thank you for supporting Getting Fit Fab.

This post was sponsored by Anthem as part of an Influencer Activation for Influence Central and all opinions expressed in my post are my own. #NavigateEnrollment #IC

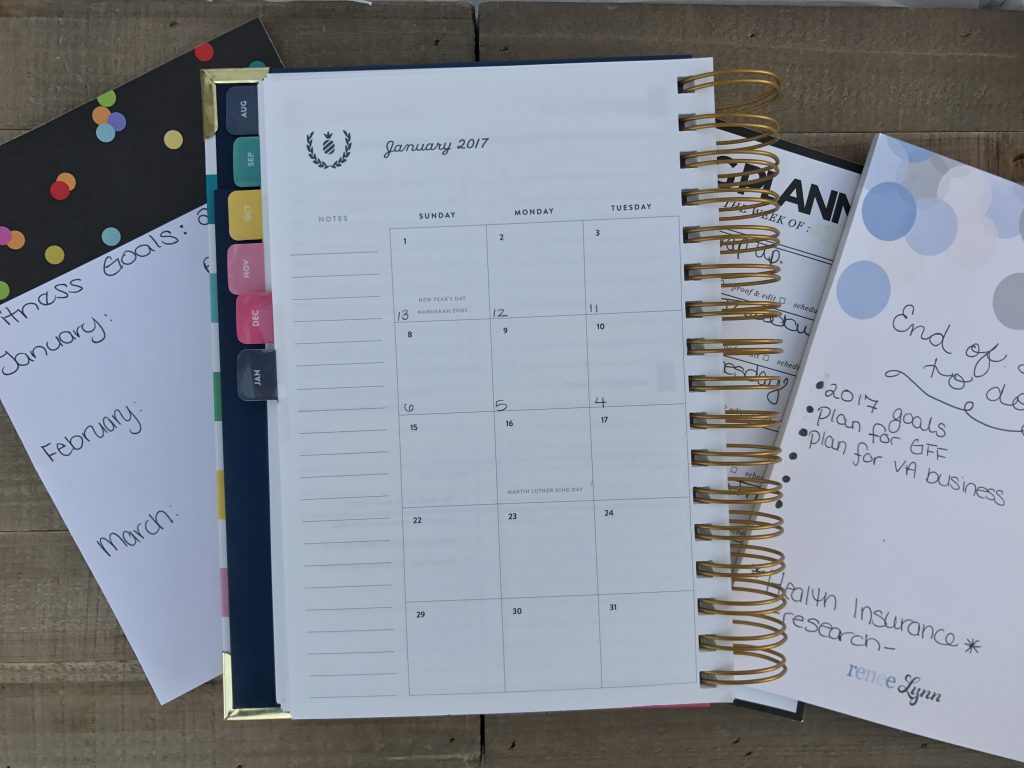

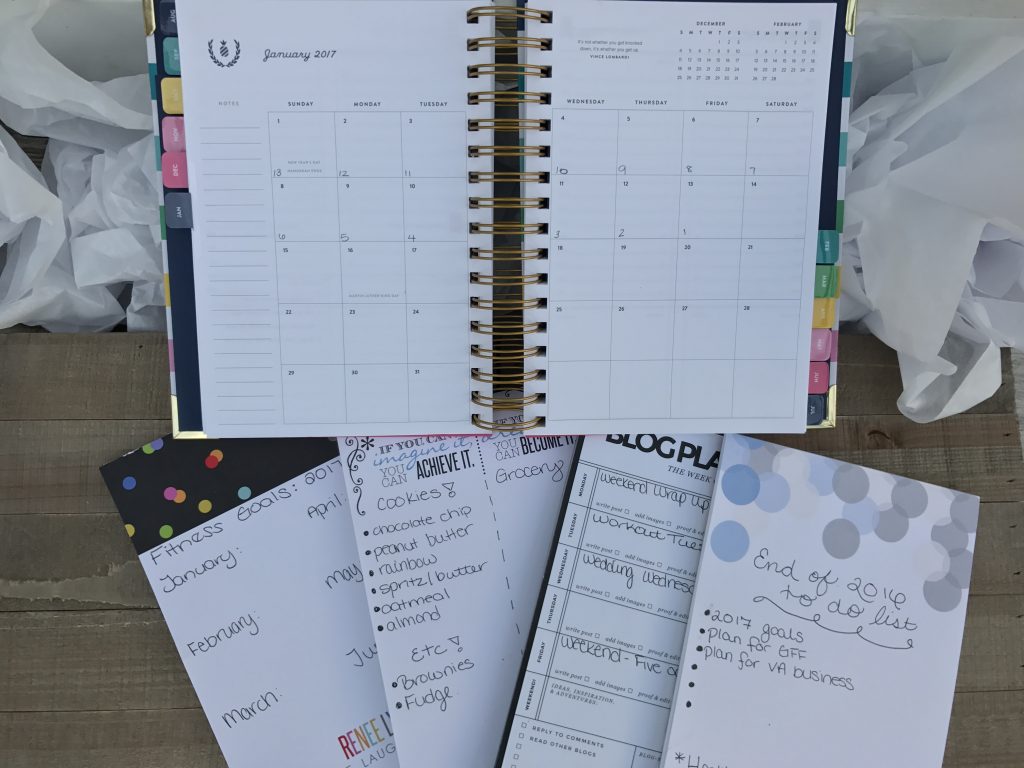

I honestly can’t believe that 2017 is right around the corner! I swear that CA & I just celebrated our wedding and are leaving on a jet plane to Europe. Now that 2017 is quickly approaching, to-do lists feel like they are 10 miles long and never ending. I’ve got a few separate ones; I’m a little odd like that, everything needs to be separate, but in the same area, or within my planner (or planners). I’ll admit I am a bit of a procrastinator with things that need to get done, my to-do lists usually last for about a month or more depending on what is on them. My Christmas list is the only one that I have more than half crossed off–it’s seriously a miracle. For my regular every month/week to-do list, I star the important ones or write them extra big so I know, those MUST be done by the deadline.

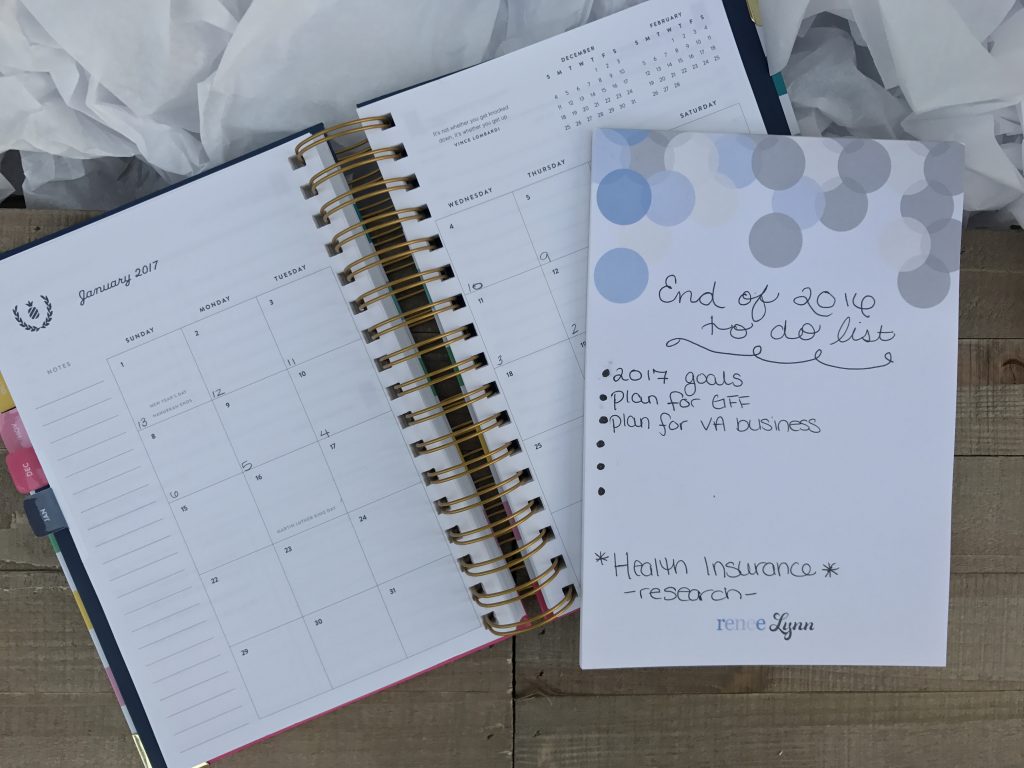

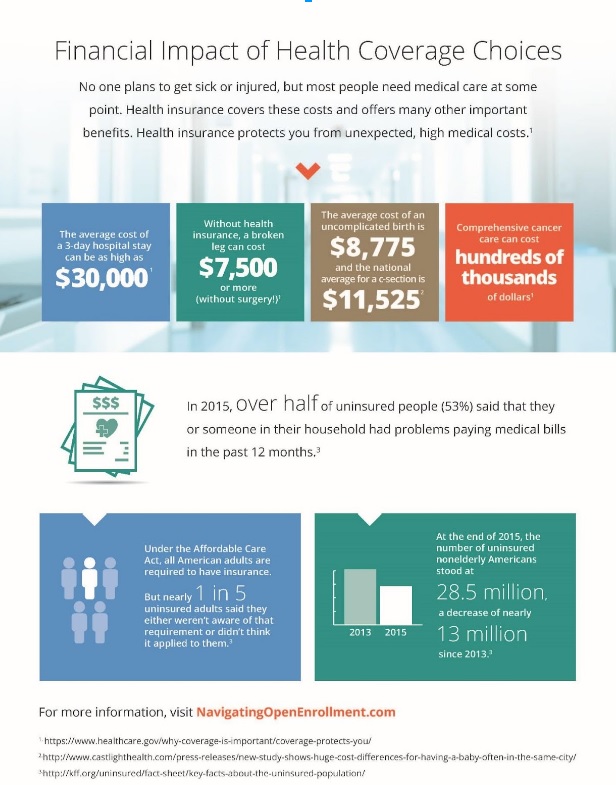

One thing that is high on my to-do list, and should be high on everyone’s list, is health insurance. Open enrollment season is upon us, the annual period when you can pick a brand new health insurance plan! Since I’ve been trying to “adult” for a few years with having my own health insurance, I’ve gotten lost in the confusing words and terms companies use, like many other people. There’s fine print that sometimes (most of the time for me), I just skim over, thinking, it’s really not that important. But, it usually is the most important part that you either skim over or skip all together. I love that health insurance companies such as Anthem are giving people resources to help us better understand our options. Application Assistors, Navigators, and brokers in your local communities can help you and your families navigate your options during the open enrollment season. This means they’ll find the plan that is the best fit for you and your loved ones. If you want more information go to navigatingopenenrollment.com or HealthCare.gov.

As a major procrastinator, I never leave important things like health insurance to the last minute. To-do lists can be over whelming and extremely long, but I always make sure the most important items are either bigger, starred or even in a different color. I’ve always been a bit of a list maker, so this is nothing new to my lifestyle. Along with to do lists, I’ve written down fitness goals for 2017, that I would like the get by either end of year or by certain months. With goals comes a plan that helps you accomplish all the goals you’ve set for yourself. With health insurance, you can write down the basics before you make the call: the amount of people that need coverage, birthdays, illnesses, and more. Also, keep enough room on the notepad for important information that should be written down, the bottom line for the new health insurance you’ve signed up for and maybe the name of the broker and or navigator that helped you sign up for your new health insurance.

Don’t forget to head to navigatingopenenrollment.com or HealthCare.gov and feel more at ease when selecting your new health insurance plan.

What are your goals for the end of the year? 2017?